THE WEEK

Stocks having their worst single day performance since June on Chairman Jerome Powell reiterating what he’s been saying all year long: the Fed is dead set on fighting inflation and will not pull back on rate hikes until they see enough evidence that prices are coming down.

- The Fed is intent on not repeating the mistakes of the 1970s where they prematurely loosened monetary conditions which led to inflation’s resurgence later in the decade.

- Because of this, the market’s hoped-for “dovish pivot” seems unlikely at least through the end of this year.

Powell committed the Fed to “taking forceful and rapid steps” and to “keep at it until we are confident the job is done.” (emphasis added).

Today’s volatility is noise—recall that a market pricing in perfection makes it extremely fragile—but it does indicate a resetting of expectations to a more realistic bent.

- Inflation is still much too high and tighter financial conditions will hurt the economy and company bottom lines.

- Sideways and negative volatility through the market’s worst month, September, are to be expected in the run up to the next round of rate hikes on the 21st.

POSITIVES:

- University of Michigan Consumer Sentiment for August, while still low, beat expectations.

- Inflation expectations, which play a significant role in the life cycle of rising prices, decreased in August.

- Q2 GDP growth was revised upward; it’s still negative but not as deeply negative.

- PCE inflation, the Fed’s preferred measure, eased in July month-over-month and year-over-year.

NEGATIVES:

- S&P Composite business activity index came in at contraction levels for the month.

- Regional manufacturing indexes continue to show deep contractions in activity.

- Trimmed Mean PCE inflation (this excludes all outlier prices) still advanced in July although the pace of the increase was mild.

KEY TAKEAWAYS

Sideways and negative volatility through September for equity markets.

- The Nasdaq is still in a bear market (-23% away from its high) and the S&P is still -14% from its high.

We’re keeping an eye on the 10-year Treasury yield.

- The yield headed north of 3% with the Fed’s latest hawkishness and stock swoon.

- It peaked at 3.48% in June right around the stock market’s bottom.

The Fed is committed to smashing inflation and the market has to come to terms with the implications for the economy and balance sheets.

MARKET CHARTS

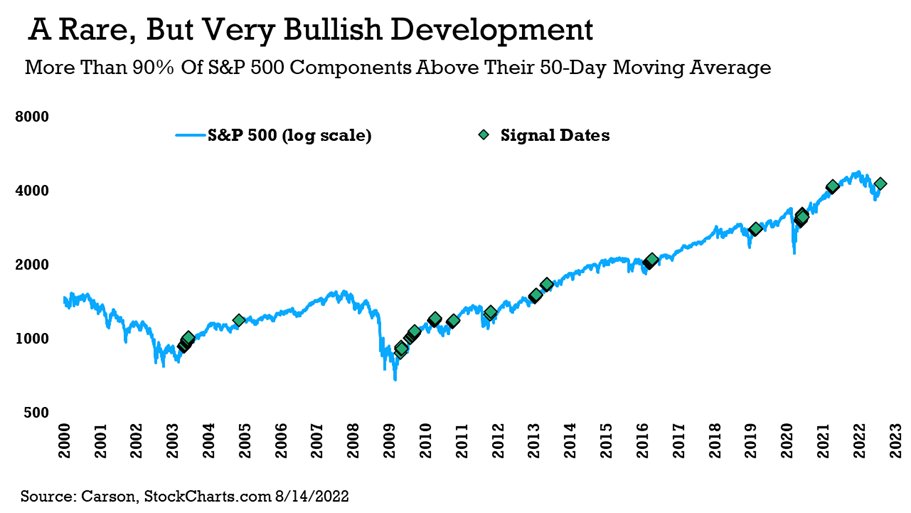

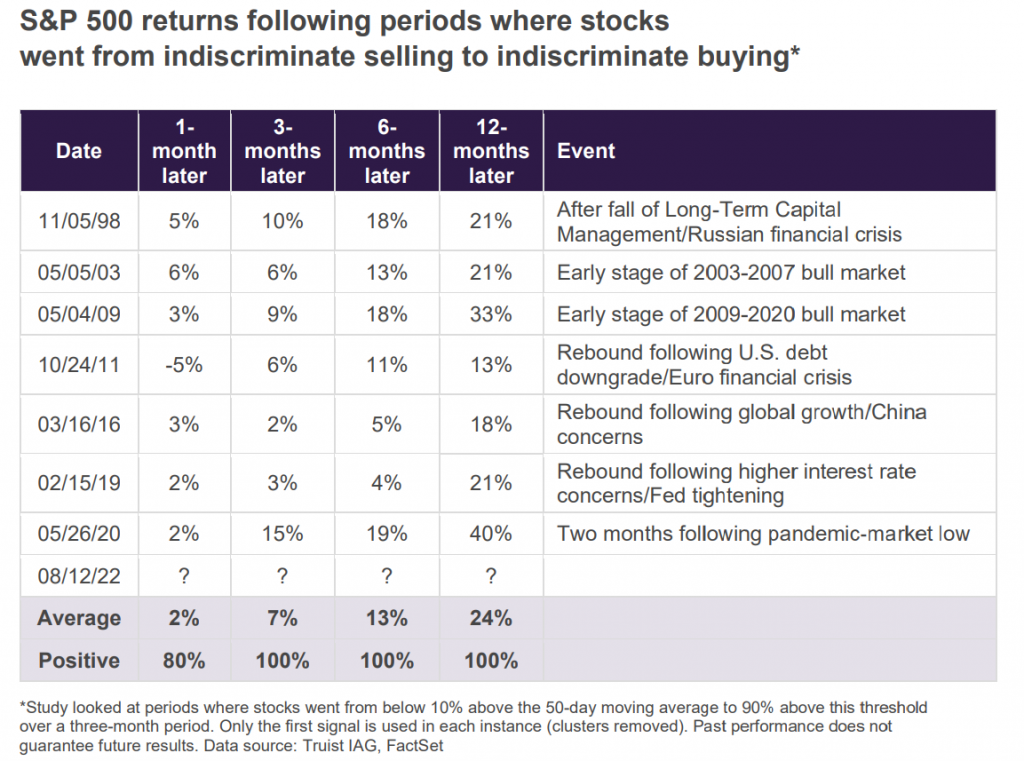

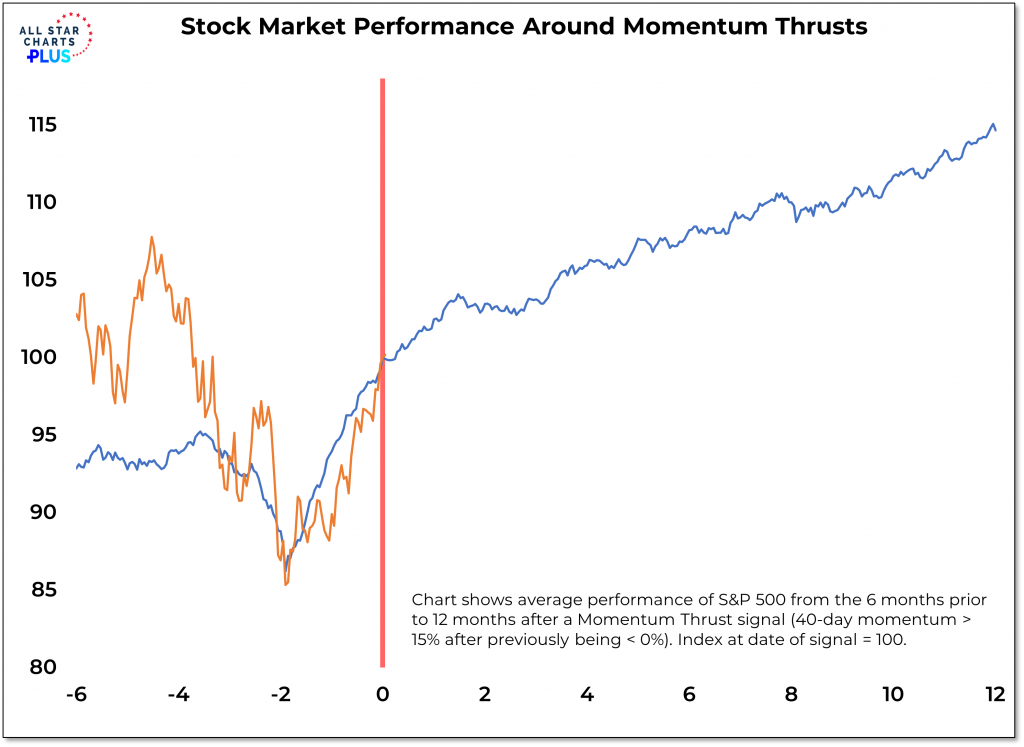

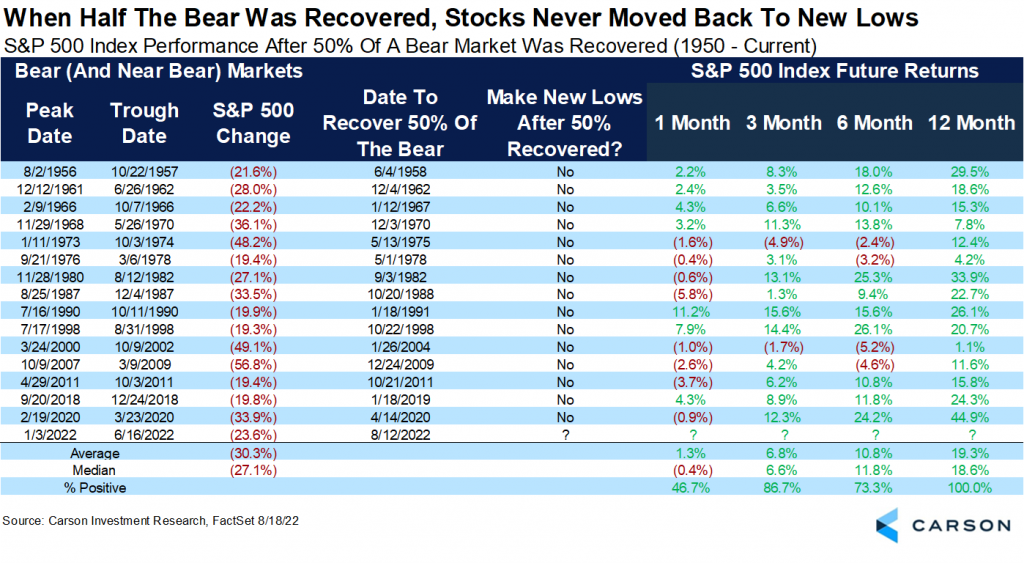

EXHIBIT 1 - Post 50% Recovery mark a bottom?

- Of the 16 times the S&P 500 has dropped -20% and recovered 50% of those losses, it has never made a new low.

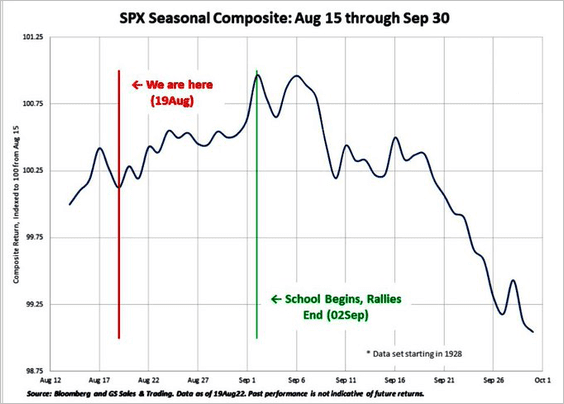

EXHIBIT 2 - Don’t want to see you in September

- Post-Summer markets have historically underperformed (the average monthly performance is -.7%).

- After September and October volatility, however, the market tends to rise throught the end of the year.

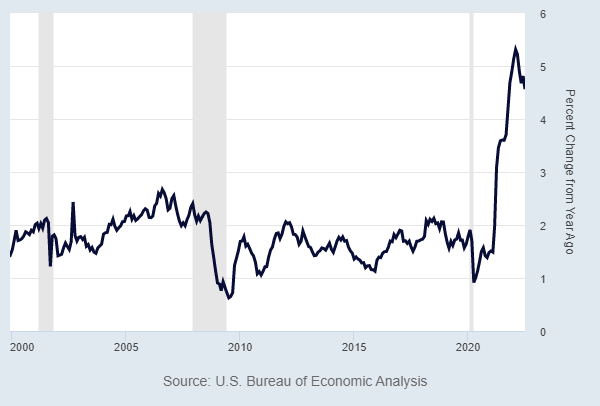

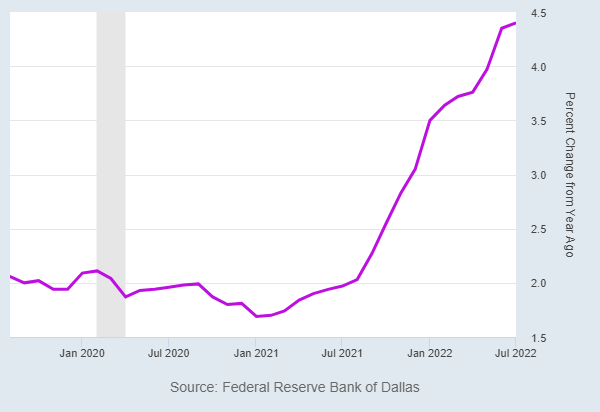

EXHIBIT 3 - Inflation easing, remains high

- The Fed’s favorite measure of inflation, the Personal Consumption Expenditures (PCE) index excluding food and energy, continues to trend downward year-over-year. Note that it’s still at 4.6%, more than double the preferred rate of inflation.

- The Trimmed Mean PCE number removes both positive and negative outliers and still shows prices increasing, albeit at a slower rate than we saw in June.

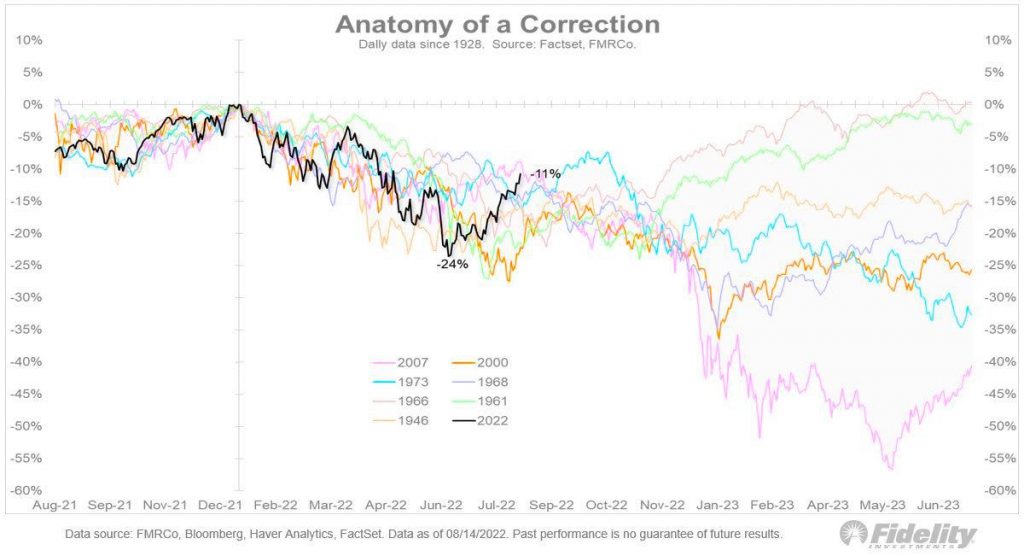

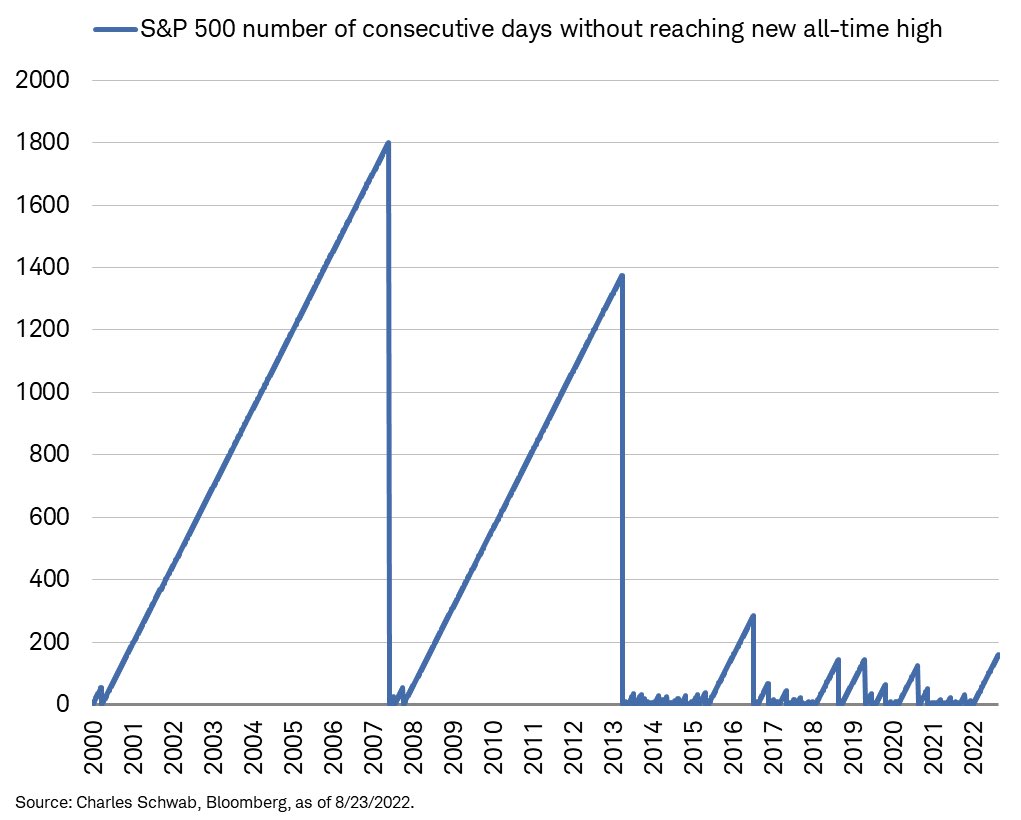

EXHIBIT 4 - Bear Market Perspectives

As you can see the 2000s bear markets went thousands of days without reaching new highs. We’re currently at 162 days.

©2022 EdgeTech Analytics, LLC. All rights reserved.

Important Disclosures: The views expressed above reflect the views of EdgeTech Analytics, LLC and are for informational purposes only. These views are not intended to serve as a substitute for personalized investment advice. Past performance is no guarantee of future results and no investment strategy or methodology can guarantee profits or protect against losses.